Tax asset depreciation calculator

Cost Rs. By using the formula for the straight-line method the annual depreciation is calculated as.

View Monthly Detail For Fixed Asset Depreciation Calculation Depreciation Guru

This means that many business purchases will need to account for deprecation in.

. Build Your Future With A Firm That Has 85 Years Of Investing Experience. This means the van depreciates at a rate of. You can use this tool to.

However the Calculator is. Qualified Asset - if your asset is a qualified asset select the special allowance including the new 100 bonus depreciation. Section 179 deduction dollar limits.

The MACRS Depreciation Calculator uses the following basic formula. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

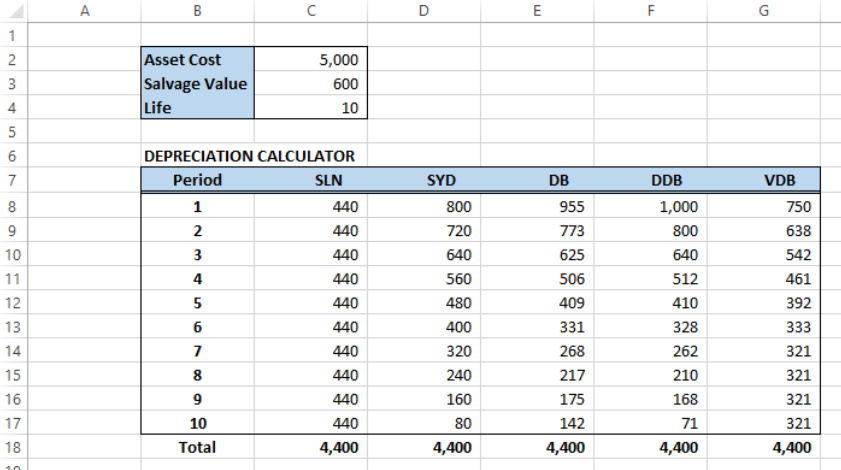

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. This limit is reduced by the amount by which the cost of. The four most widely used depreciation formulaes are as listed below.

The tool includes updates to. PPF Maximum Withdrawal Calculator. For the financial year 2020-21 the.

The depreciation rate stays the same throughout the life of the asset used in this calculator. Depreciation Calculator as per Companies Act 2013. Depreciation rate as per the Income Tax Act 15.

Depreciation Calculator Pro has been fully updated to comply with the changes made by the Tax Cuts and Jobs Act TCJA legislation that affect the calculation of fixed asset depreciation. Depreciation rate finder and calculator. Straight Line Depreciation Method.

Depreciation Calculator has been fully updated to comply with the changes made by. Depreciation rate as per the Companies Act 10. Depreciation Calculator Companies Act 2013.

It provides a couple different methods of depreciation. C is the original purchase price or basis of an asset. Depreciation Calculator As Per Income Tax Act.

Dn rate of different assets is different. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Generally the corporation must refigure depreciation for the AMT including depreciation allocable to inventory costs if the.

Rental Income Calculator Calculate ROI return-on-investment. Ad Partner with Aprio to claim valuable RD tax credits with confidence. There are four main methods to account for depreciation.

Before you use this tool. Find the depreciation rate for a business asset. Depreciation that must be refigured for the AMT.

35000 - 10000 5 5000. Calculate depreciation for a business asset using either the diminishing value. First one can choose the straight line method of.

The depreciation calculator above is provided as a general guide to allow you to estimate the potential depreciation you may be entitled to claim on a property. For instance a widget-making machine is said to depreciate whe. Asset Depreciation Calculator HOW IT WORKS The value of an asset will most likely decrease over time.

Depreciation asset cost salvage value useful life of asset. This depreciation calculator is for calculating the depreciation schedule of an asset. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment.

Where Di is the depreciation in year i. So it helps the accounting software to exactly calculate the yearly depreciation of different assets as different rates are fitted for different assets. Depreciation calculations are made for both regular tax and alternative minimum tax AMT purposes.

D i C R i. Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Free Macrs Depreciation Calculator For Excel

1 Free Straight Line Depreciation Calculator Embroker

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation In Excel Excelchat Excelchat

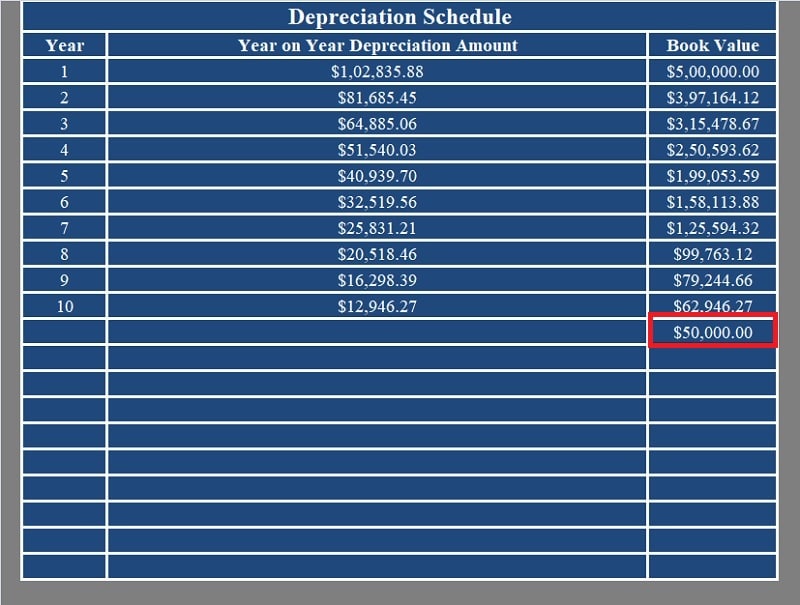

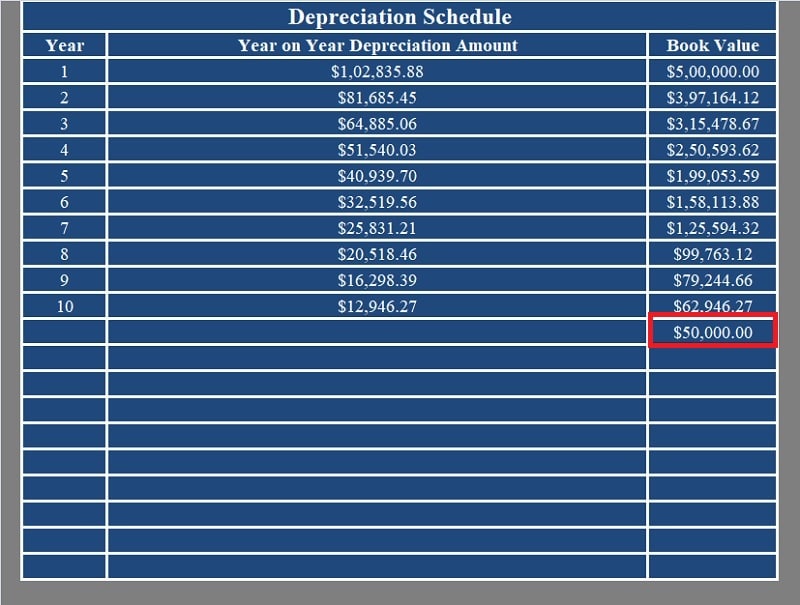

Depreciation Schedule Formula And Calculator

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Schedule Formula And Calculator

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Formula And Calculator